ATM Cash Withdrawal Tax Pakistan 2025

In Pakistan, when you withdraw cash after a bank (via an ATM or counter) and you are not on the Central Panel of Revenue (FBR) Active Taxpayer List (ATL) — sense you are a non-filer — then a suppression duty is practical on the total quantity you withdraw in a solitary day if it crosses a set brink. If you are a filer (your title is on the ATL), then you are usually excused from this tax.

Quick Info Table for ATM Cash Withdrawal Tax Pakistan 2025

| Program / Tax | Start Date | End Date | Rate & Threshold | Method of Application |

|---|---|---|---|---|

| Cash Withdrawal Tax for Non-Filers | Effective from Finance Act 2025 (1 July 2025) | Ongoing until changed by law | 0.8% on amount above Rs 50,000 per day for non-filers; filers pay 0% on such withdrawals. | Deducted automatically by the bank at withdrawal |

| Daily Threshold (Non-Filers) | Same effective date | Ongoing | Currently Rs 50,000 per day; though a proposal is to raise to Rs 75,000 per day for non-filers. | Bank monitors aggregate withdrawals in a day |

Who Pays This Tax?

- If your designation is on the ATL (i.e., you are a tax-filer) → You do not pay suppression tax on cash removals above the verge.

- If your name is not on ATL (i.e., you are a non-filer) → The bank will subtract tax when your total cash withdrawals in one day exceed the verge.

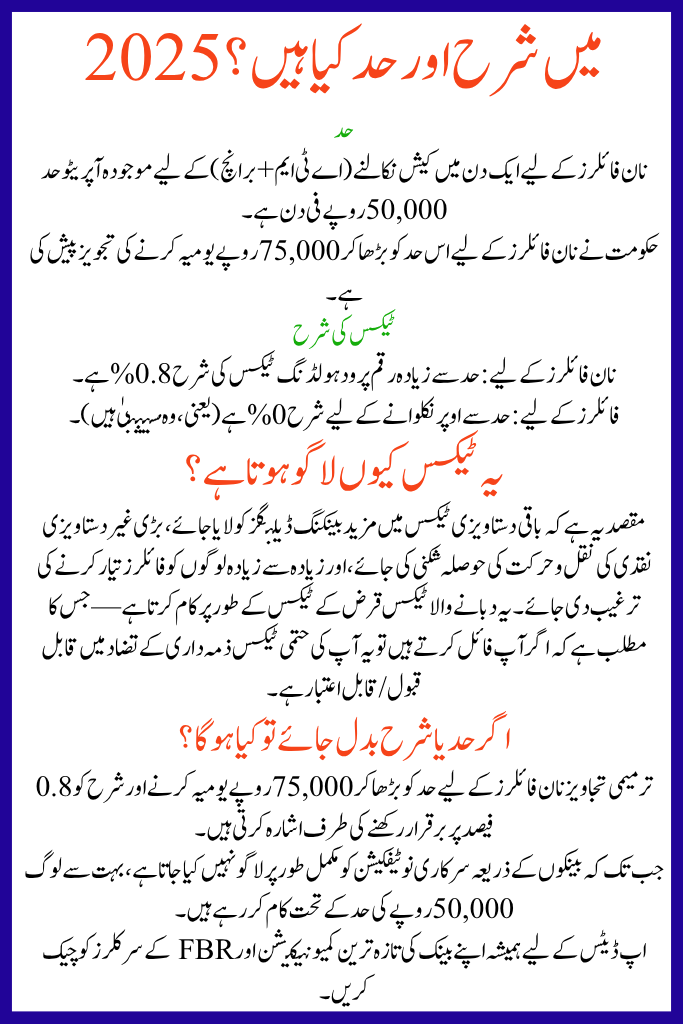

What Are the Rate & Limit in 2025?

Threshold

- The current operative threshold is Rs 50,000 per day for cash withdrawals (ATM + branch) in one day for non-filers.

- The government has proposed increasing this threshold to Rs 75,000 per day for non-filers.

Tax Rate

- For non-filers: The withholding tax rate is 0.8% on the amount above the threshold.

- For filers: The rate is 0% for withdrawals above the threshold (i.e., they are exempt).

How the Tax Works — Examples

- If you are a non-filer and you withdraw Rs 60,000 in one day:

- Threshold = Rs 50,000 → amount above threshold = Rs 10,000

- Tax = 0.8% of Rs 10,000 = Rs 80

- If you withdraw Rs 200,000 in one day:

- Amount above threshold = Rs 150,000

- Tax = 0.8% of Rs 150,000 = Rs 1,200

Exemptions & Special Cases

- Filers (on ATL) are exempt from this withholding tax on cash withdrawals.

- Accounts solely funded by foreign remittances under specific conditions may also have special treatment (check with your bank).

- The rule applies whether you withdraw via ATM or over the counter (branch cash withdrawal) — it is not limited to ATM only.

Why Is This Tax Applied?

The objective is to bring more banking dealings into the documented tax remaining, discourage large undocumented cash movements, and encourage more people to develop filers. This suppression tax acts as an loan tax—meaning it’s adaptable/creditable in contradiction of your final tax liability if you file.

What if the Threshold or Rate Changes?

- The amendment proposals indicate a move to raise the threshold to Rs 75,000 per day for non-filers, and maintain the rate at 0.8%.

- Until the official notification is fully implemented by banks, many are operating under the Rs 50,000 threshold.

- Always check your bank’s latest communication and the FBR circulars for updates.

FAQs– ATM Cash Withdrawal Tax Pakistan 2025

What is the tax rate for 2025 on ATM cash withdrawals?

For non-filers: 0.8% on the amount withdrawn in one day exceeding Rs 50,000. For filers: 0%.

Does the tax apply if I withdraw multiple times in a day?

Yes. The sum of all cash withdrawals in one day is used to test the threshold.

Was the limit raised to Rs 75,000?

It has been proposed and agreed to by the finance committee to raise it to Rs 75,000, but operationally many banks still apply Rs 50,000.

Are foreign-remittance–only accounts exempt?

Yes, under conditions specified by FBR/banks — always check with your bank.

Is this tax refundable?

It is an advance tax. If you are a non-filer and later become compliant and file tax returns, you may adjust it. Filers do not face the deduction.

What Should You Do?

- Check whether your name appears on the ATM Cash Withdrawal Tax Pakistan 2025 and ensure your tax-filer status.

- Monitor how much cash you withdraw in a single day (sum of all withdrawals) so you don’t get surprised by the tax if you are a non-filer.

- If you are a filer, keep your proof of filer status handy in case banks wrongly apply the tax.

- Stay updated with your bank’s policies and FBR notifications about thresholds and rates.

Conclusion

In short: If you are on the ATM Cash Withdrawal Tax Pakistan 2025, you are exempt from tax on daily cash removals above the verge. If you are not on ATL (non-filer) and your cash withdrawals in one day exceed Rs 50,000, you will be exciting 0.8% advance tax on the amount above that verge. The verge may be raised to Rs 75,000 per day in upcoming, so keep an eye on informs.