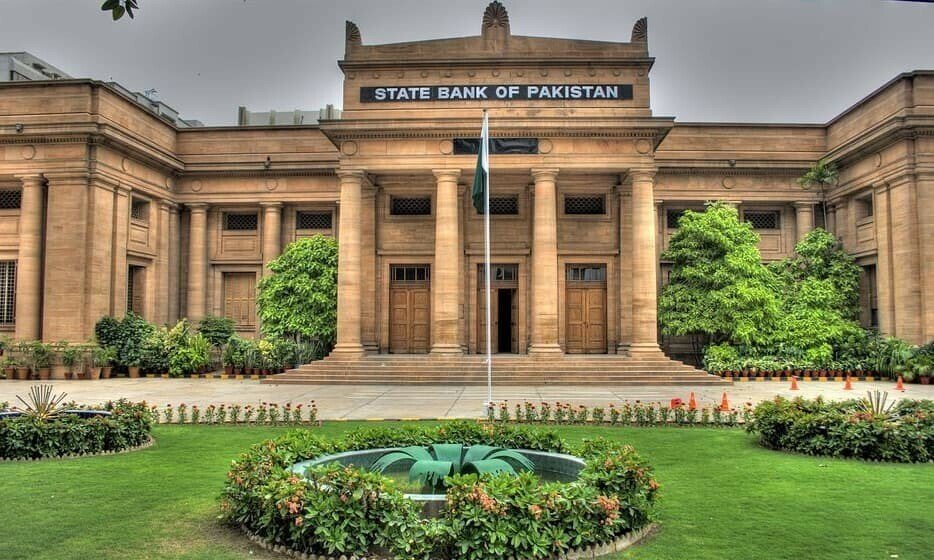

State Bank Loan Scheme

The State Bank SBP Loan Scheme 2025 is an important opportunity for people in Pakistan who want to start or expand their business but do not have enough money. This scheme has been introduced to support young entrepreneurs, small business owners, women, and skilled professionals who need financial help. Through this program, applicants can get affordable loans with simple conditions and a flexible repayment system. The goal is to create more jobs, support new ideas, and help the economy grow. The loans can be used for shops, services, agriculture, manufacturing, or any legal small business setup. This scheme encourages self-employment nationwide.

Quick Overview

| Feature | Detail |

|---|---|

| Loan Amount | Rs. 20 lakh to Rs. 35 lakh |

| Age Limit | 21 to 45 years |

| Repayment Tenure | 3 to 8 years |

| Type of Loan | Low-interest business financing |

State Bank SBP Loan Scheme Overview 2025

The State Bank SBP Loan Scheme 2025 has been launched to make business financing simple, fair, and accessible for all Pakistanis. It supports both new and existing businesses by offering affordable loans with low markup rates. The scheme specially encourages young people, women, and small business owners who have ideas but lack funds. It also supports agriculture, manufacturing, IT services, and home-based industries. The goal is to reduce unemployment by helping people start income-generating activities. This initiative is part of the government’s plan to reduce poverty and promote financial independence.

Eligibility Requirements in the State Bank Loan Scheme 2025

To qualify for the State Bank SBP Loan Scheme, applicants must fulfill a few basic conditions. The age range is from 21 to 45 years, and they must have a valid CNIC. Applicants should also present a clear business plan that explains how they will use the loan. Educational degree is not required, which makes the program easy for everyone. People from any city, village, or semi-urban area can apply, making the scheme highly inclusive. Women and youth are given special preference to support equal opportunities. A simple financial capacity check is also required.

Bullet Points (Para 1):

- Must be a Pakistani citizen

- Age between 21 to 45 years

- Valid CNIC required

- Feasible business or startup plan needed

Loan Features Offered in the State Bank Loan Scheme

The State Bank SBP Loan Scheme offers several helpful features to make borrowing easy for new and existing business owners. Applicants can receive loans ranging from Rs. 20 lakh to Rs. 35 lakh. The repayment time is from 3 to 8 years, which makes monthly installments affordable. In some cases, a grace period is allowed, helping businesses grow before starting repayments. The loans can be used for buying tools, machinery, shop setup, or expanding a business. Small loans may also be available without collateral, especially for women or youth-focused startups.

Bullet Points (Para 2):

- Loan amount: Rs. 20 to 35 lakh

- Repayment tenure: 3 to 8 years

- Grace period allowed for selected businesses

- Low markup rates for easy repayment

How to Apply for the State Bank Loan Scheme 2025

Applying for the State Bank SBP Loan Scheme is a simple and organized process. The first step is preparing a business plan that clearly explains your goals, costs, expected profits, and working method. Then, applicants should visit any nearby participating bank such as NBP, HBL, BOP, or Meezan Bank. At the bank, the applicant will receive a form that must be filled with personal and business details. After attaching CNIC copies, photos, and documents, the application is submitted for review. The bank may also conduct a short interview before final approval and disbursement.

Partner Banks Under the State Bank Loan Scheme

The State Bank SBP Loan Scheme is supported by several big banks across Pakistan to ensure transparency and accessibility. These banks are responsible for receiving applications, verifying documents, and approving loans. Some of the main banks include the National Bank of Pakistan (NBP), Habib Bank Limited (HBL), Bank of Punjab (BOP), and Meezan Bank for Islamic financing options. Microfinance banks like Khushhali also participate to support small borrowers. This large network ensures that anyone from any area can apply easily. The partnership improves customer service and ensures fast and fair loan processing.

Major Benefits of the State Bank Loan Scheme for Pakistan

The State Bank Loan Scheme brings several economic and social benefits to Pakistan. It encourages entrepreneurship, allowing young people to turn their ideas into real businesses. Women-led startups get special support, helping increase financial independence for females. The scheme also creates more job opportunities, which reduces unemployment and improves living standards. By supporting small and medium enterprises, the program strengthens local markets and boosts national growth. It also encourages innovation in the agriculture, service, and manufacturing sectors. This scheme is an important step toward a stronger and more self-reliant Pakistan.

Conclusion

In this article, we are sharing all the details about the State Bank Loan Scheme 2025, including its benefits, eligibility, loan features, and application process. This scheme is an excellent opportunity for young and hardworking individuals who want to start their own business or expand an existing one. With low-interest rates, flexible repayment plans, and support for women and small businesses, it offers a strong foundation for financial independence. Anyone with a solid business idea can take advantage of this loan and start their journey toward success.

FAQs

Q1. Can students apply for the State Bank Loan Scheme 2025?

Yes, students can apply if they are 21 years or older and have a valid business plan.

Q2. Does the scheme support home-based businesses?

Yes, home-based startups such as baking, tailoring, IT services, and online stores are fully eligible.

Q3. How long does the bank take to approve the loan?

The approval process may take 2 to 6 weeks depending on document verification and bank workload.

Q4. Can I apply if I have never taken a loan before?

Yes, first-time borrowers are welcome, and many small applicants are supported without collateral.

Related Posts