Apply Online for PM Youth Business Loan 2025

In 2025, the Government of Pakistan has revived the Prime Minister Youth Business & Agriculture Loan Scheme (PMYB&ALS), offering young entrepreneurs and farmers a real chance to start or cultivate their trades. This is a practical arrangement with interest-free or low-interest loans, a fully online application process, then clear support for both new and existing projects. In this guide, you’ll find everything you need—eligibility, required leaflets, step-by-step request method, and how long approval characteristically takes.

Quick Information Table for Apply Online for PM Youth Business Loan

| Field | Details |

|---|---|

| Scheme Name | Prime Minister Youth Business & Agriculture Loan Scheme (PMYB&ALS) |

| Start Date (2025) | Ongoing / Phase 02 launched in October 2025 |

| End Date | Not announced (scheme continues) |

| Loan Amount / Tier Limits | Tier 1: up to Rs 0.5 million, Tier 2: Rs 0.5–1.5 M, Tier 3: Rs 1.5–7.5 M |

| Interest / Markup Rate | 0% (Tier 1), ~5% (Tier 2), ~7% (Tier 3) |

| Repayment Period | Up to 8 years, with grace period |

| Collateral Required | No collateral for Tier 1; depends on bank for Tier 2 & 3 |

| Application Method | Online only via PMYP portal: pmyp.gov.pk |

What Is the PM Youth Business & Agriculture Loan Scheme 2025?

The PM Youth Loan Scheme 2025 (PMYB&ALS) is a national initiative to fight joblessness and support youth-owned businesses. The idea is to give financial help through subsidized or zero-interest loans so young Pakistanis can start new ventures, expand existing ones, or invest in agriculture. The scheme ropes a wide range of subdivisions: startups, farming, livestock, freelancing, IT/e-commerce, and more. It also gives priority to women, transgender people, and people with disabilities

Key Features of PM Youth Loan Scheme 2025

Here are the major features in Apply Online for PM Youth Business Loan 2025:

- Three loan tiers:

- Tier 1: Up to Rs 500,000 — 0% markup

- Tier 2: Rs 500,000 to 1.5 million — approx 5% markup

- Tier 3: Rs 1.5 to 7.5 million — approx 7% markup

- Repayment Period: Long-term loans can be repaid in up to 8 years, with a 1-year grace period often allowed.

- Equity Requirement: For new businesses, a 10% equity share is required in some cases.

- Quota: At least 25% quota for women applicants.

- Regional Inclusion: Open to citizens in Pakistan, including AJK and Gilgit-Baltistan. (As commonly applied in such schemes.)

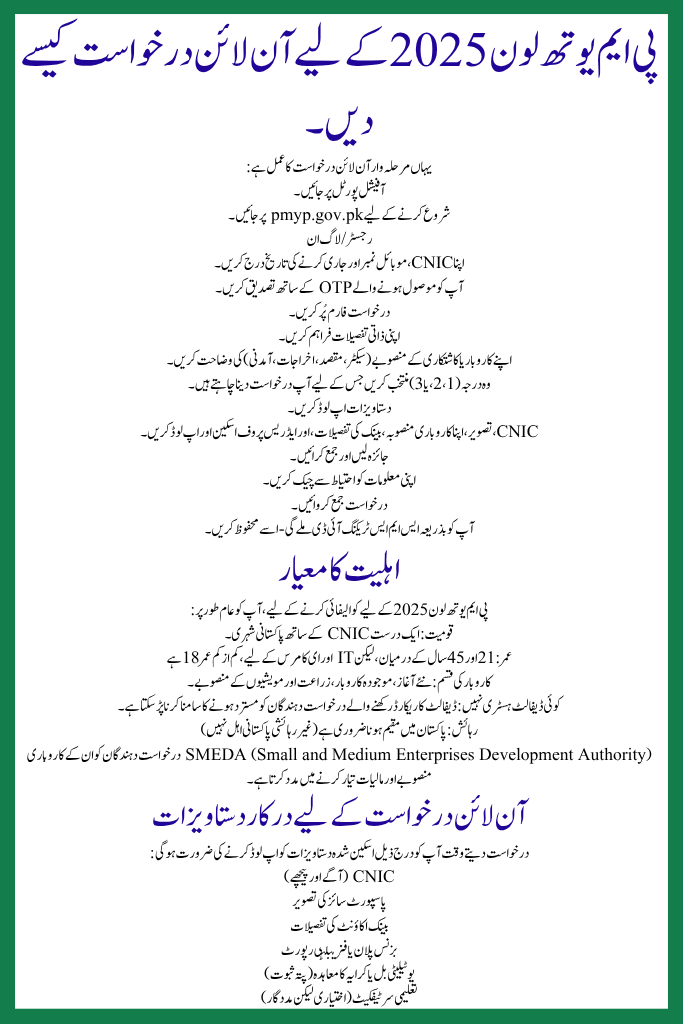

Eligibility Criteria

To qualify for the Apply Online for PM Youth Business Loan 2025, you generally need:

- Nationality: Pakistani citizen with a valid CNIC.

- Age: Between 21 and 45 years, but for IT and e-commerce, minimum age is 18

- Business Type: New startups, existing businesses, agriculture and livestock projects.

- No Default History: Applicants with a record of default may face rejection.

- Residence: Must be living in Pakistan (non-resident Pakistani not eligible)

SMEDA (Small and Medium Enterprises Development Authority) helps applicants prepare their business plans and financials.

Documents Required for Online Application

You will need to upload the following scanned documents when applying:

- CNIC (front & back)

- Passport-size photograph

- Bank account details

- Business plan or feasibility report

- Utility bill or rental agreement (address proof)

- Educational certificates (optional but helpful)

How to Apply Online for PM Youth Loan 2025

Here is the step-by-step online application process:

- Visit Official Portal

Go to pmyp.gov.pk to start. - Register / Login

- Enter your CNIC, mobile number, and issue date.

- Verify with the OTP you receive.

- Fill Out the Application Form

- Provide your personal details.

- Describe your business or farming project (sector, purpose, costs, revenue).

- Choose the tier (1, 2, or 3) you want to apply for.

- Upload Documents

- Scan and upload CNIC, photo, your business plan, bank details, and address proof.

- Review & Submit

- Check your information carefully.

- Submit the application.

- You will get a Tracking ID via SMS — save it.

What Happens After Submission + Approval Timeline

- Initial Screening: The PMYP system reviews your basic info.

- Forward to Bank: Your application is sent to a partner bank for financial assessment.

- Verification: Bank may call you or visit to verify your business plan.

- Decision: If approved, you’ll sign a loan agreement.

- Disbursement: Loan is disbursed into your bank account.

Approval Timeline: Most applications are processed within 30 to 60 days, depending on your business tier, the bank’s verification, and how complete your documents are.

How to Track Your Application Status

- Go to pmyp.gov.pk

- Click on “Application Status Check”

- Enter your CNIC and Tracking ID

- See real-time updates on your application stage

Tips to Boost Your Approval Chances

- Prepare a clear, realistic business plan — no exaggeration.

- Be honest with your financial estimates (cost, income).

- Upload high-quality scans of all required documents.

- Use SMEDA’s business templates (balance sheet, cash flow) to make your plan stronger. (pmybals.pmyp.gov.pk)

- Choose the correct loan tier based on your real needs — don’t apply for too much if you don’t need it.

- Keep your Tracking ID safe to follow up.

Final Thoughts

The Apply Online for PM Youth Business Loan 2025 is a influential tool for youth in Pakistan who want to build their own businesses or invest in agriculture. With low or zero markup, long repay periods, and a fully online application system, this scheme brands free enterprise available to many more people — especially young and talented Pakistanis.

If you meet the eligibility criteria, have a clear business idea, and can prepare the required leaflets, applying is well worth it. Use the PMYP portal, take advantage of SMEDA’s provision, and track your application carefully. This could be the stepping stone to your commercial success.

Related Posts