CM Punjab Business Loan Scheme

Rising inflation and unemployment in Pakistan have made it hard for many people to start their own businesses. In response, the CM Punjab Business Loan Scheme 2025, also known as the Asaan Karobar Finance Program, has emerged as a ray of hope.

Launched by the Chief Minister of Punjab, this initiative aims to empower youth, women, and small business owners by offering interest-free and low-markup business loans.

Whether you run a small shop in Lahore or a home-based business in Multan — this program is designed to help you grow financially.

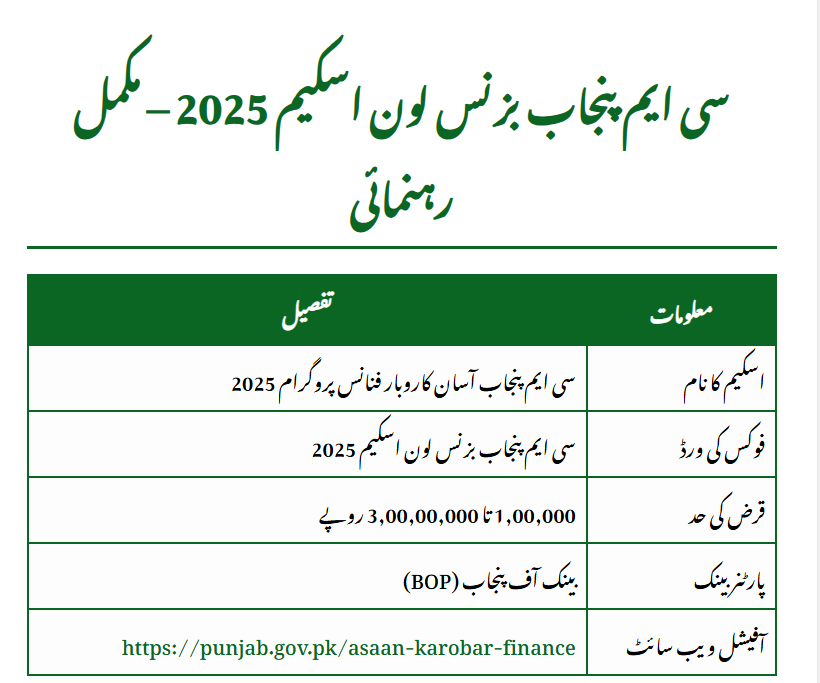

🔹 Key Details

| Information | Details |

|---|---|

| Scheme Name | CM Punjab Asaan Karobar Finance Program 2025 |

| Focus Keyword | CM Punjab Business Loan Scheme 2025 |

| Loan Range | Rs. 100,000 to Rs. 30 million |

| Partner Bank | Bank of Punjab (BOP) |

| Official Website | https://punjab.gov.pk/asaan-karobar-finance |

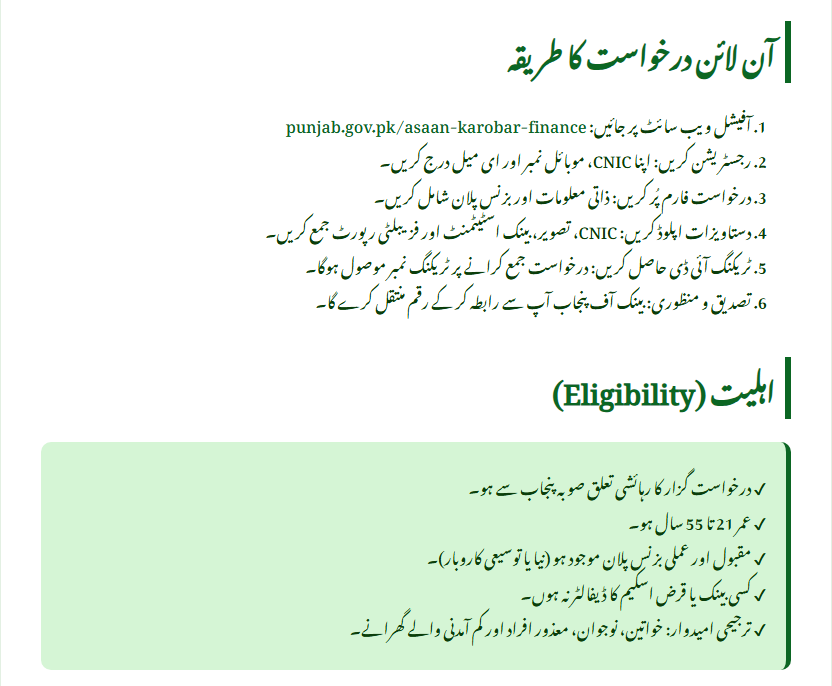

❓ How to Apply Online for the Punjab Business Loan Scheme 2025?

Here’s the step-by-step process to apply online:

- Visit the Official Website:

Go to https://punjab.gov.pk/asaan-karobar-finance - Register an Account:

Enter your CNIC, mobile number, and email address to sign up. - Fill Out the Form:

Provide your personal details, business plan, and required loan amount. - Upload Documents:

Attach scanned copies of your CNIC, business plan, bank statement, and other required files. - Get a Tracking ID:

Once you submit your application, you’ll receive a tracking number to monitor the status. - Verification & Approval:

After verification, the Bank of Punjab team will contact you and transfer the loan to your account.

❓ Who is Eligible for the Punjab Business Loan Scheme 2025?

To qualify for the loan, applicants must meet the following requirements:

- Must be a resident of Punjab.

- Age limit: 21 to 55 years.

- Have a business plan (new or existing).

- Must not be a bank defaulter.

- Preference for women, youth, disabled persons, and low-income families.

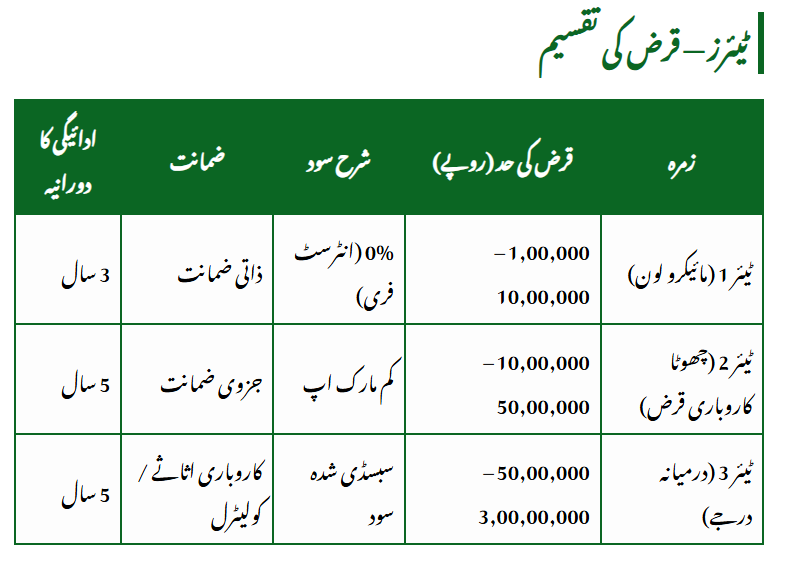

❓ What Are the Loan Categories in the Punjab Business Loan Scheme 2025?

| Category | Loan Amount | Interest Rate | Security | Repayment Period |

|---|---|---|---|---|

| Tier 1 (Micro Loan) | Rs. 100,000 – Rs. 1,000,000 | 0% (Interest-Free) | Personal Guarantee | 3 Years |

| Tier 2 (Small Business Loan) | Rs. 1,000,000 – Rs. 5,000,000 | Low Markup | Partial Guarantee | 5 Years |

| Tier 3 (Medium Enterprise Loan) | Rs. 5,000,000 – Rs. 30,000,000 | Subsidized Interest | Business Assets | 5 Years |

This tier system ensures that both small and medium businesses can benefit.

For example, a tailor in Sahiwal can get Rs. 500,000 interest-free, while a manufacturing unit in Gujranwala can apply for up to Rs. 10 million.

❓ Which Documents Are Required for the Punjab Business Loan Scheme 2025?

Prepare the following documents before applying:

- Valid CNIC

- Recent passport-size photo

- Business plan or feasibility report

- Bank account details

- Proof of residence (utility bill or rent agreement)

- Business registration certificate (if available)

- NTN (optional but recommended)

Having these ready ensures faster application processing.

❓ How Will the Punjab Asaan Karobar Finance Program 2025 Impact the Economy?

The program is designed to boost Punjab’s economy and create sustainable growth:

- Thousands of jobs will be generated.

- Women entrepreneurs will gain financial independence.

- Digital startups and freelancers will thrive.

- Small and medium enterprises (SMEs) will become stronger.

- Dependence on government jobs will decrease.

It’s not just a loan — it’s a step toward economic empowerment and a self-reliant Punjab.

💬 Frequently Asked Questions (FAQs)

Q1: What is the Punjab Business Loan Scheme 2025?

It’s a government loan program that provides interest-free and low-markup loans to youth, women, and small business owners in Punjab.

Q2: Who can apply for this loan?

Any resident of Punjab aged 21–55 years with a business idea or an existing business.

Q3: How much can I borrow under this scheme?

You can borrow up to Rs. 30 million depending on your business category.

Q4: Is the loan completely interest-free?

Yes, Tier-1 loans are interest-free. Other tiers have low or subsidized markup rates.

Q5: How can I apply online?

Visit https://punjab.gov.pk/asaan-karobar-finance, fill out the online form, upload your documents, and submit your application.

🏁 Conclusion

The CM Punjab Business Loan Scheme 2025 is a golden opportunity for ambitious individuals looking to start or expand their businesses.

It’s transparent, digital, and designed to promote financial independence.

If you have a business idea, skill, or passion — now is the time to turn it into reality.

Apply today through the official Asaan Karobar Finance Portal and take your first step toward success.

Related Posts