Gold Price Drop

A sudden and historic drop in gold prices across Pakistan has surprised both buyers and economic analysts. In 2025, gold prices recorded one of the biggest declines in the country’s history, marking a major shift in the financial landscape. At a time when global markets are under pressure, this sharp fall in gold prices has come as a huge relief—especially for families planning weddings or investors waiting for the right moment.

For the first time in months, buyers are returning to jewelry shops, markets are becoming active again, and investors are revising their strategies. This situation is crucial for anyone who deals with gold—whether as jewelry, savings, or long-term investment.

In this article, we break down why gold prices dropped, how it impacts your financial decisions, what global factors are involved, and whether this is the right time to buy gold. The goal is to provide clear, useful, and reliable information to help you understand the current market and make better choices.

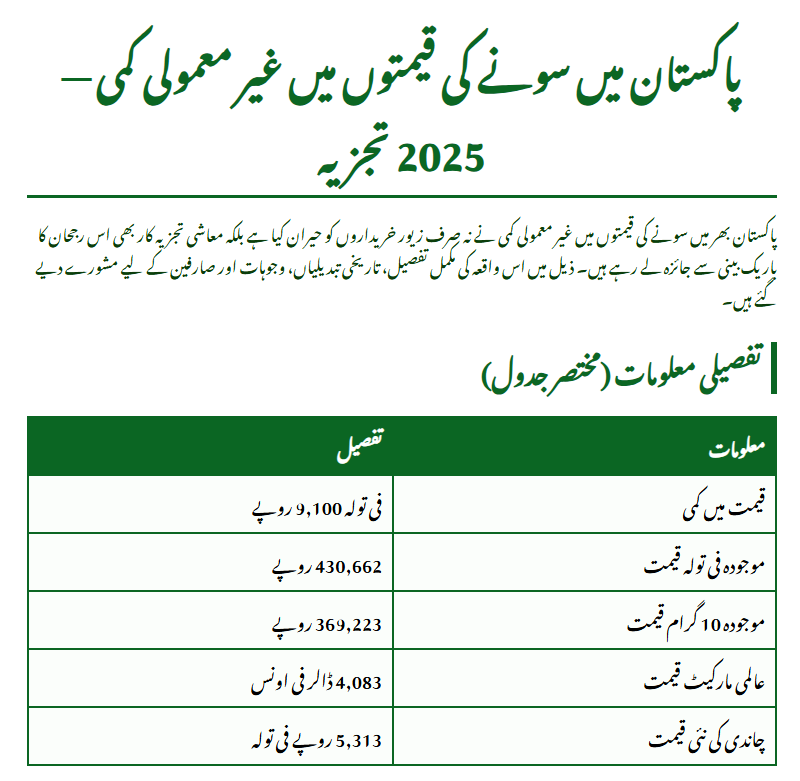

Detailed Information

| Detail | Information |

|---|---|

| Price Drop | Rs. 9,100 per tola |

| Current Price (per tola) | Rs. 430,662 |

| Current Price (10 grams) | Rs. 369,223 |

| Global Market Price | $4,083 per ounce |

| New Silver Price | Rs. 5,313 per tola |

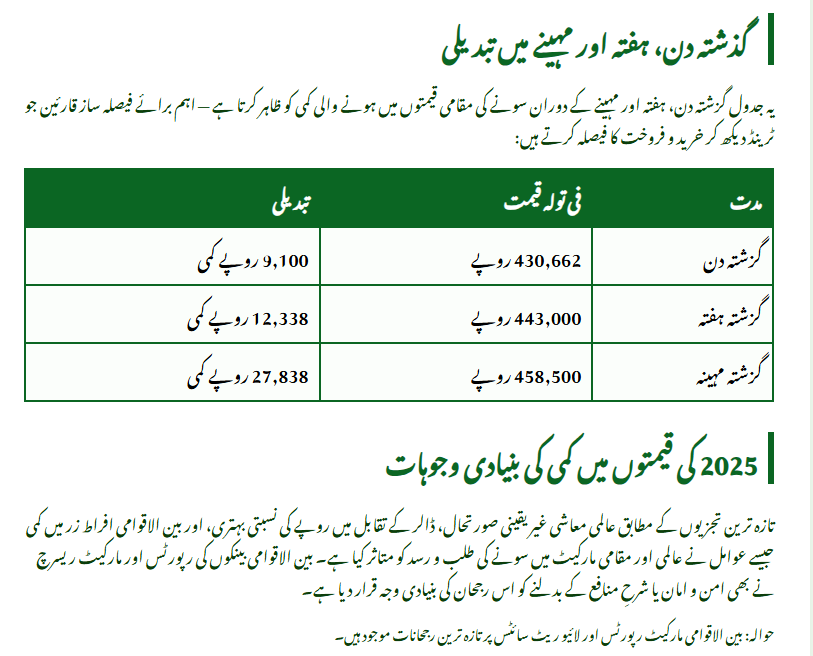

How Have Gold Prices Changed in the Last Day, Week, and Month?

Below is a simple and clear table showing how gold prices moved over the last day, week, and month. This is especially important for buyers who want to track long-term trends before making a purchase.

Gold Price Trend Record

| Time Period | Price per Tola | Change |

|---|---|---|

| Last Day | Rs. 430,662 | Rs. 9,100 decrease |

| Last Week | Rs. 443,000 | Rs. 12,338 decrease |

| Last Month | Rs. 458,500 | Rs. 27,838 decrease |

What Caused the Major Gold Price Drop in 2025?

The most significant reason behind this historic drop is the instability in global financial markets. Investors worldwide are selling gold and moving their money into other assets, which increases supply and pushes prices down. Internationally, gold fell by $91 per ounce—this directly affected Asian and Pakistani markets.

Another major factor is the slight improvement in Pakistan’s currency value and a decline in global inflation. These two elements combined pushed gold prices downward. Experts believe this decline may be temporary, and any shift in global conditions might bring gold back up again.

How Can the Average Buyer Benefit from This Drop?

The historic gold price drop in 2025 is a golden opportunity for the average Pakistani buyer. Families who postponed gold shopping due to inflation are now returning to the market. Wedding seasons, which slowed down due to high costs, may see increased activity again.

Benefits for Buyers:

- Lower overall jewelry-making costs

- Best time to buy for long-term investment

- Buyers returning, increasing market activity

- Affordable opportunity to purchase gold

- Jewelers expecting improved business

Can Gold Prices Drop Even More?

This is a common question among buyers and investors. According to analysts, it depends mainly on global market conditions. If the US dollar weakens further or inflation continues to drop, gold may fall even more. But if global tensions rise or stock markets weaken, gold prices could shoot up again.

For this reason, buyers are advised to monitor daily market rates and make timely decisions before prices change abruptly.

How Will This Price Drop Affect Pakistan’s Economy?

The historic gold price drop in 2025 can bring several positive effects to the local economy. It may increase overall market activity, reduce the cost of imported gold, and improve the buying power of the general public.

However, if gold remains cheap for too long, foreign investors may shift from gold to other investments, which could impact long-term stability. For now, the short-term impact appears largely positive for both consumers and local businesses.

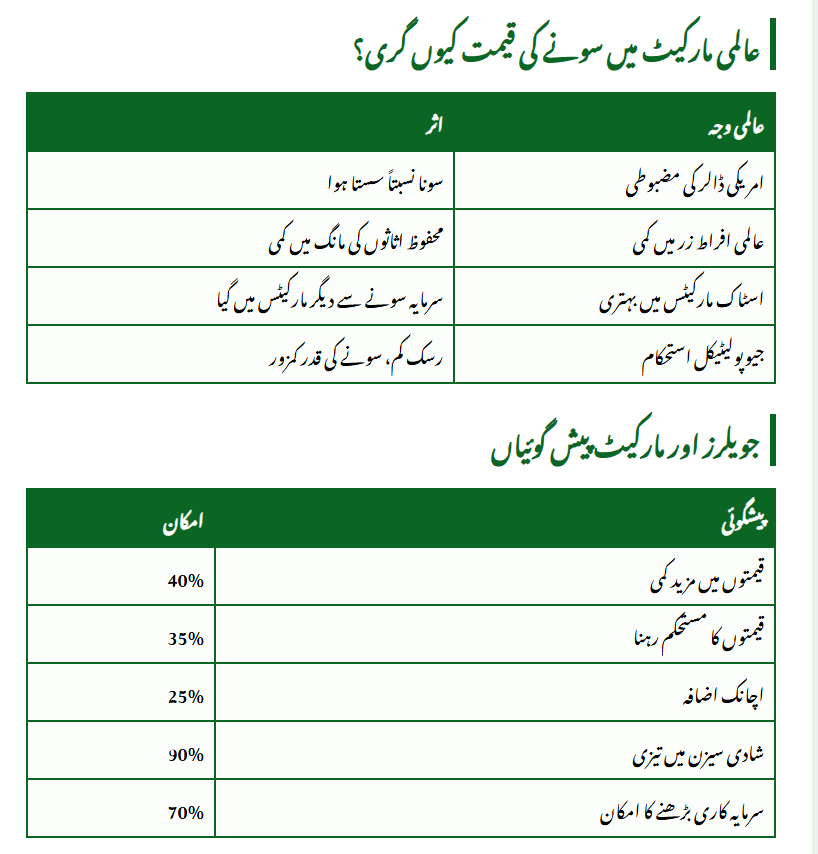

Why Did Global Gold Prices Fall?

| Global Factor | Impact |

|---|---|

| Strong US Dollar | Reduced gold prices |

| Lower Global Inflation | Investors sold gold |

| Strong Stock Markets | Money shifted from gold to markets |

| Pressure on Energy Markets | Safe-haven demand decreased |

| Geopolitical Stability | Reduced fear-driven buying |

What Do Pakistani Jewelers Expect Next?

| Prediction | Probability |

|---|---|

| Further price drop | 40% |

| Prices remain stable | 35% |

| Sudden price increase | 25% |

| Strong wedding-season demand | 90% |

| Increase in investment buying | 70% |

Should You Buy Gold Now? What Experts Suggest

Experts say this is one of the best times to buy gold, especially for long-term investors. If you’re purchasing gold for weddings or savings, the current dip gives you a cost advantage you may not see again soon.

However, those looking for quick profit should keep a close eye on daily rates, as markets can reverse unexpectedly. In the current situation, slow and steady investment is considered most beneficial.

Conclusion

The historic gold price drop in 2025 has opened a window of opportunity for millions of Pakistanis. With global pressure, improved currency value, and reduced inflation, gold has become significantly cheaper. This is a rare financial opportunity to buy gold for weddings, savings, or long-term investment.

Still, the future depends entirely on global and local economic conditions. Buyers are advised to stay updated with market rates and make smart, timely decisions.

Official Website:

https://www.finance.gov.pk

Frequently Asked Questions (FAQs)

1. Why did gold prices fall so much in Pakistan in 2025?

Because global gold prices dropped sharply, and Pakistan’s currency strengthened slightly, causing a major price reduction locally.

2. Is this the right time to buy gold?

Yes, many experts consider this the best buying opportunity for long-term investment and wedding season purchases.

3. Can gold prices fall even further?

It is possible if global markets remain stable and inflation decreases. But any global crisis could push prices back up.

4. Why is global gold getting cheaper?

Due to strong stock markets, lower inflation, a strong US dollar, and reduced global uncertainty.

5. Will gold prices increase again soon?

Analysts say prices may rise if global tensions grow or the dollar weakens. It is important to monitor daily updates.

Related Posts