Government 4 Interest-Free Loan Schemes 2025 in Pakistan

In 2025, the Government of Pakistan has once again introduced robust interest free loan systems to support young people, women, farmers, and small business owners. These programs remain built to reduce poverty, endorse small businesses, and help citizens move forward without the burden of interest. The main drive is to create equal opportunities and support economic growth across the republic. Below is the complete and easy director casing eligibility, leaflets, and the online request process.

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

|---|---|---|---|---|

| PM Youth Business & Agriculture Loan Scheme | 2025 | Not announced | Up to Rs. 7.5 million | Online |

| Kamyab Jawan – Interest Free Loans | 2025 | Not announced | Rs. 100,000 to Rs. 5 million | Online |

| Akhuwat Foundation Interest Free Microfinance | 2025 | Not announced | Rs. 10,000 – Rs. 150,000 | Online / Offline |

| Ehsaas Interest-Free Loan Scheme | 2025 | Not announced | Rs. 20,000 – Rs. 100,000 | Offline (Centers) |

What Are Interest-Free Loan Schemes?

Interest-free loan schemes are government supported packages that provide financial assistance deprived of any interest (riba). People only repay the same quantity they borrow. These loans follow Islamic finance values and are designed to support:

- Financial inclusion

- Small business growth

- Women empowerment

- Youth development

- Poverty reduction

Top 4 Government 4 Interest-Free Loan Schemes 2025 in Pakistan

1. Prime Minister Youth Business & Agriculture Loan Scheme (PMYB&ALS)

The PM Youth Business & Agriculture Loan Scheme supports young entrepreneurs and farmers by offering easy, interest-free, and low-interest loans.

Key Features

- Eligibility: Pakistani citizens aged 21–45 (18 years for IT sector)

- Loan Amount: Up to Rs. 7.5 million

- Category 1 Loans: Up to Rs. 0.5 million are completely interest-free

- Repayment Period: 3 to 8 years

- Apply Online: pmyb.gov.pk

Required Documents

- CNIC

- Bank account

- Business plan

- Educational certificates

2. Kamyab Jawan Program – Interest-Free Loans

The Kamyab Jawan Program is part of the PM Youth Initiative. It focuses on creating employment and supporting young people in starting small businesses.

Highlights

- Eligibility: Age 18–45 years

- Loan Limit: Rs. 100,000 to Rs. 5 million

- Interest Rate: 0 percent to 5 percent based on category

- Apply Online: kamyabjawan.gov.pk

How to Apply

- Visit the official website.

- Register using CNIC.

- Fill the loan form and upload documents.

- Wait for bank verification and approval.

Partner banks include NBP, SMEDA, and others.

3. Akhuwat Foundation Interest-Free Microfinance

Akhuwat Foundation provides interest-free loans to low-income individuals through its microfinance program.

Scheme Overview

- Loan Range: Rs. 10,000 – Rs. 150,000

- Interest: 0 percent, no service charges

- Focus Areas: Small businesses, education, housing, health

- Apply: Nearest Akhuwat branch or akhuwat.org.pk

Eligibility

- Pakistani citizen

- Must have CNIC

- Must have a guarantor

- Should have a clean repayment history

Akhuwat has already supported over 5 million families across Pakistan.

4. Ehsaas Interest-Free Loan Scheme (Under BISP / NBP Partnership)

This scheme is part of the Ehsaas Poverty Reduction Program. It helps low-income households start small businesses.

Key Information

- Loan Amount: Rs. 20,000 – Rs. 100,000

- Interest Rate: 0 percent

- Eligibility: Families living below the poverty line

- Apply At: Nearest Ehsaas Loan Center or partner bank

Online Registration

- Check eligibility at ehsaas.nadra.gov.pk using your CNIC.

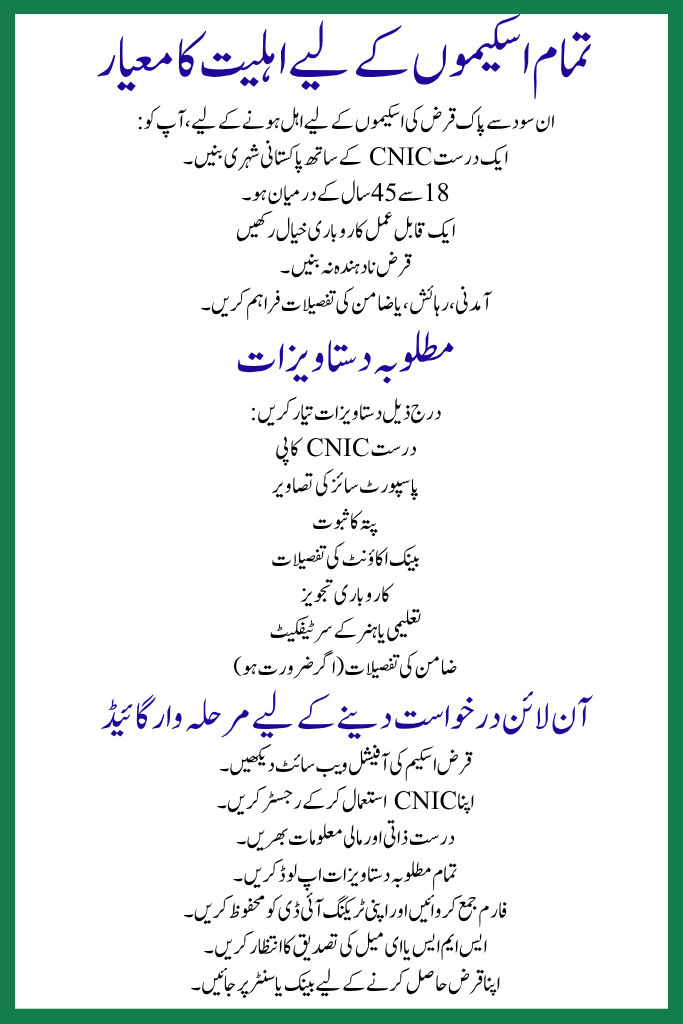

Eligibility Criteria for All Schemes

To qualify for these interest-free loan schemes, you must:

- Be a Pakistani citizen with a valid CNIC

- Be between 18 to 45 years

- Have a workable business idea

- Not be a loan defaulter

- Provide income, residence, or guarantor details

Required Documents

Prepare the following documents:

- Valid CNIC copy

- Passport-size photos

- Address proof

- Bank account details

- Business proposal

- Educational or skill certificates

- Guarantor details (if needed)

Step-by-Step Guide to Apply Online

- Visit the official website of the loan scheme.

- Register using your CNIC.

- Fill in accurate personal and financial information.

- Upload all required documents.

- Submit the form and save your tracking ID.

- Wait for SMS or email verification.

- Visit the bank or center to receive your loan.

Tips to Increase Loan Approval Chances

- Write a simple and clear business plan

- Make sure CNIC and documents are updated

- Avoid past loan defaults

- Provide a guarantor if possible

- Track your application regularly

Frequently Asked Questions–Government 4 Interest-Free Loan Schemes 2025 in Pakistan

Can students apply?

Yes. Students can apply for educational or startup loans under PM Youth and Ehsaas.

Are these loans fully interest-free?

Yes. First-tier loans up to Rs. 0.5 million are 100 percent interest-free.

How long does approval take?

Normally 30 to 60 days.

What if repayment is delayed?

Delay may cause legal action or disqualification from future schemes.

Conclusion

Government 4 Interest-Free Loan Schemes 2025 in Pakistan are a strong chance for Pakistanis to start or expand their trades without the stress of interest. Whether you are a student, small agriculturalist, or young tycoon, these schemes can help you move forward with confidence. For the latest updates, always visit the official organization websites.

Related Posts