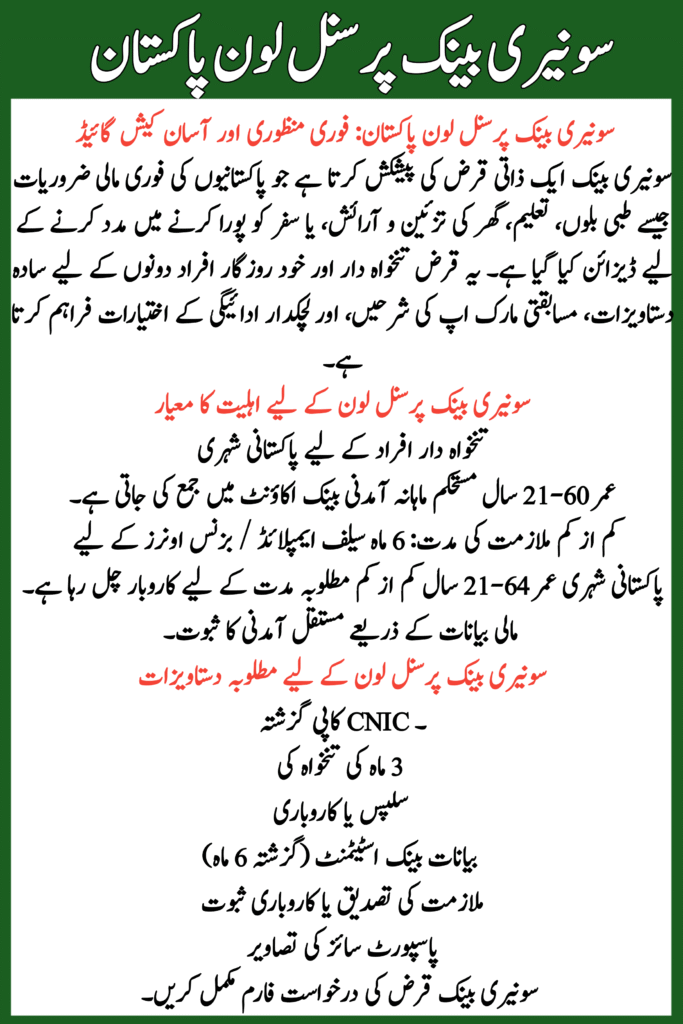

Soneri Bank offers a personal loan designed to help Pakistanis meet urgent financial needs such as medical bills, education, home renovation, or travel. The loan provides simple documentation, competitive mark-up rates, and flexible repayment options for both salaried and self-employed individuals.

Table of Contents

| Feature | Detail |

| Loan Amount | PKR 50,000 – PKR 3,000,000 |

| Repayment Tenure | 12, 24, 36, 48 months |

| Interest / Mark-Up Rate | Based on 1-Year KIBOR plus bank spread |

| Processing Fee | 1% of the loan amount (minimum PKR 2,000) |

| Collateral | Not required for salaried applicants (unsecured) |

| Prepayment | Allowed after 6 months with conditions |

| Eligibility — Salaried | Pakistani national, age 21–60, stable income |

| Eligibility — Self-Employed | Pakistani national, age 21–64, business income proof |

What Is Soneri Bank Personal Loan Pakistan?

Soneri Bank Personal Loan is an unsecured financing option for individuals who need quick cash without pledging property. It can be used for personal expenses like weddings, education, medical bills, or home improvement. Information is based on the official Soneri Bank website.

Read More: Punjab Rozgar Scheme

Eligibility Criteria for Soneri Bank Personal Loan

For Salaried Individuals

- Pakistani citizen

- Age 21–60 years

- Stable monthly income credited to a bank account

- Minimum employment duration: 6 months

For Self-Employed / Business Owners

- Pakistani national aged 21–64 years

- Business operating for minimum required duration

- Proof of consistent income through financial statements.

Read More: Meezan Bank Islamic Personal Loan Pakistan

Required Documents for Soneri Bank Personal Loan

- CNIC copy

- Last 3 months salary slips or business statements

- Bank statements (last 6 months)

- Employment verification or business proof

- Passport-size photographs

- Completed Soneri Bank loan application form

Application Process for the Soneri Bank Personal Loan

- Visit Official Website: Soneri Bank Personal Loan

- Check Loan Features: Review loan amount, tenure, and interest rates

- Verify Eligibility: Confirm age, income, and employment criteria

- Prepare Documents: Gather all mandatory documents

- Submit Application: Apply online or visit the nearest branch

- Verification Process: Bank verifies employment, credit score, and income

- Loan Approval: If criteria are met, the loan is approved

- Disbursement: Funds transferred to your account.

Read More: Sindh Worker Welfare Card

Key Features of Soneri Bank Personal Loan

- Unsecured Loan: No collateral required for salaried individuals

- Flexible Tenure: 12–48 months

- Transparent Charges: Clear processing fees

- Prepayment Options: Partial repayment allowed after 6 months

Benefits

- Quick access to funds for personal needs

- Simple online or branch application process

- Transparent terms and policies

- Reliable customer support

Things to Consider

- Interest rate is based on KIBOR plus bank spread

- Processing fee: 1% of loan amount (minimum PKR 2,000)

- Prepayment may have terms; check official policy

- Stable income improves approval chances

Helpline & Contact

- Official Website: https://www.soneribank.com/personal-banking/personal-loans/personal-loan

- Customer Helpline: 111-667-111

- Branch Visit: Visit any Soneri Bank branch to speak with a loan officer.

Conclusion

Soneri Bank Personal Loan Pakistan is a fast, flexible, and accessible financing solution for salaried and self-employed individuals. With clear eligibility, simple documentation, and competitive repayment terms, it covers a wide range of personal financial needs. Always apply via the official Soneri Bank website to ensure safe and accurate processing.

Read More: E-Motorcycle Scheme Registration

FAQs

What is the minimum loan amount?

Soneri Bank offers personal loans starting from PKR 50,000.

What is the maximum tenure?

Loan repayment can extend up to 48 months.

Can self-employed individuals apply?

Yes, provided they can show consistent business income.

How fast is the loan disbursed?

Funds are usually transferred within a few working days after approval.